Industry Trend Reports

As wealth managers, we live and work within a dynamic environment. The U.S. Election, BREXIT, OPEC , Syria’s civil war and FOMC meetings all influenced markets during 2016. What were the major trends which influenced the wealth management industry?

Here are three trends from 2016 to keep an eye on.

Trend #1 – Clients Want to Know: What is a Fiduciary?

We can’t talk about 2016 without mentioning the DOL Fiduciary ruling. Regardless of your opinion on the rule itself, or whether President Trump will block implementation, clients and prospects learned what it means to be a fiduciary in 2016.

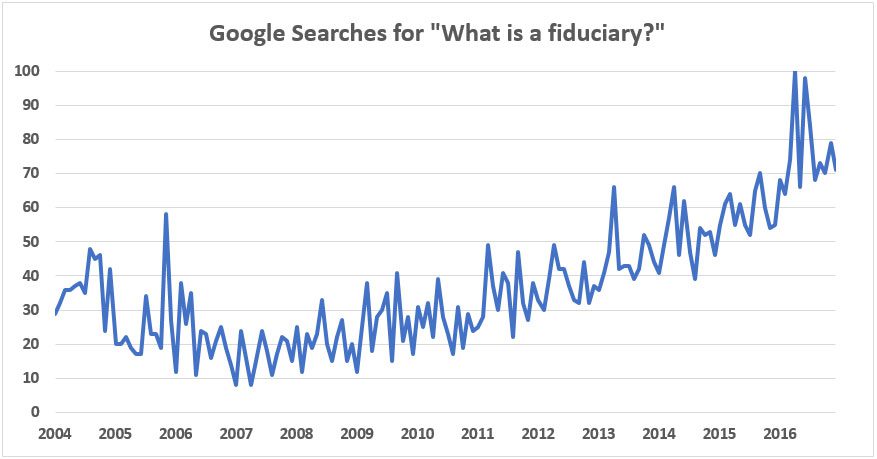

The chart below shows Google searches for “What is a Fiduciary” in the United States between January of 2004 and December of 2016. This chart is indexed, with the highest search volume during the period shown as 100. March of 2016 saw the highest volume of this search term during the last decade, and you don’t need to be a technical trader to see the overall trend.

What does this mean moving forward? In the context of the fiduciary ruling, it can be useful to imagine wealth management on a “fiduciary spectrum”. At one end, we have pure-commission insurance agents. At the other end, we have fee-only advisors. Somewhere in the middle, are stock brokers and financial advisors who are compensated on a transactional or AUM basis.

2016 saw a shift in consumer sentiment, due to the DOL ruling, which will continue to encourage client movement toward the fee-only end of this spectrum.

Trend #2 – The Wirehouse Migration Continues

For advisors working within wirehouses, investment banks or large broker-dealers, a major selling point is: “You know our brand, you know our history, trust us with your money.” This approach works until major public relation issues occur.

Wells Fargo and Deutsche Bank both ran into legal trouble during 2016 and in April, the Federal Reserve and FDIC issued a warning that five of the nation’s eighth largest banks are still too big to fail . This, combined with aggressive presidential campaign rhetoric directed at domestic financial institutions, worked to weaken public perception of these firms during 2016.

Many advisors are left asking the question: “is my firm’s brand helping, or hurting, new client acquisition?”

In 2016, 14 of the 20 largest advisor moves, based on AUM, where advisors leaving the wirehouse channel and entering the independent or regional broker-dealer space .

Trend #3 – The Flow of Money From Active to Passive Strategies

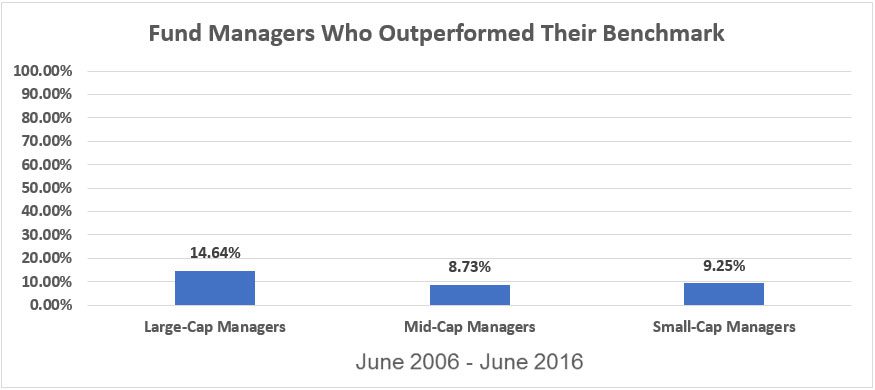

What may end up as the most lasting trend from 2016 was the continued flow of money from active to passive strategies. The underperformance by active managers, as a whole, continues to drive this fund movement. During the last 10 years, just 14.64% of large-cap managers, 8.73% of Mid-Cap Managers and 9.25% of Small-Cap Managers outperformed their respective indices

In terms of fund volume, active investment strategies saw annual net outflows of $359 billion through November of 2016. The notable exception within the active investment space were taxable bond funds and municipal bond funds which saw $9 billion and $48 billion of net inflows, respectively. This compares to a passive space which saw growth from every segment during 2016, with net inflows of $480 billion . The major beneficiary of this movement toward passive investment strategies was the ETF space, which realized inflows of $252.8 billion during 2016 .

What Does This All Mean For You?

Whether you align with a fiduciary vs traditional model, active vs passive style, broker vs independent platform – the reality is that the wealth management industry is changing, fast. In order to survive in this increasingly competitive environment laden with alternatives (and robos), we all need to pay attention to the larger sentiment shifts in order to stay competitive.

We built Miracle Mile Advisors with the vision of creating a place where clients want to invest and advisors want to work. As a 100% employee owned, independent firm, we can adjust what needs altering, and constantly improve our offering.

In our modern world with seemingly limitless options, we owe it to ourselves to stay educated and open to new possibilities.