Navigating Election Uncertainty From the CIO's Desk

Matt Dmytryszyn, CFA

As we close in on a week until election day, the outcome remains highly uncertain. It seems that each of the recent presidential elections has become more important than the previous one. Next week’s election pits two candidates with highly divergent views on several policies. Moreover, it’s expected that the races for control of both the House of Representatives and the Senate will be close calls as well. This makes the investing landscape more challenging as policies could vary markedly depending on what happens in the races for the presidency, the House, and the Senate.

At this juncture, it appears the most likely probability is that the election will conclude with a divided government. We note that betting odds point to around a 40% probability of a red (Republican) sweep, and a 10% chance of a blue (Democrat) sweep.1 We expect both chambers to have small majorities, with current polling indicating a greater likelihood that Democrats will take the House of Representatives and Republicans will take the Senate. Thus, regardless of who wins the presidency, it’s likely they will have to reach across the aisle in order to push through any policy advancement.

Historical Perspective

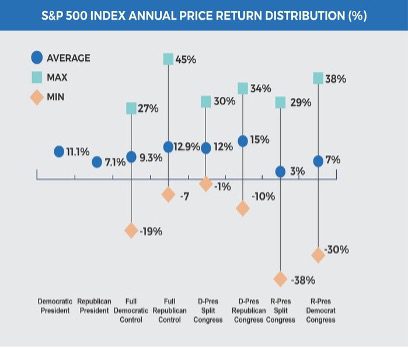

In our view, markets can over-extrapolate the historical market performance of past presidential winners. For starters, we often hear statistics quoted around the average return under a Democrat or Republican president. On average the S&P 500 has returned 11% under a Democrat president, versus 7% on average under a Republican2. However, returns are even higher at 13% when there is Republican control of the White House and both chambers of Congress.2 We don’t put much credence in this statistic as they neglect to account for economic conditions going into the administration or whether the President’s party held a majority in Congress. Ultimately what markets prefer is a divided government with little change. Ambiguity leads to concerns and volatility, while inaction is a positive from an investment standpoint as future conditions are more certain.

Impact of Potential Policies

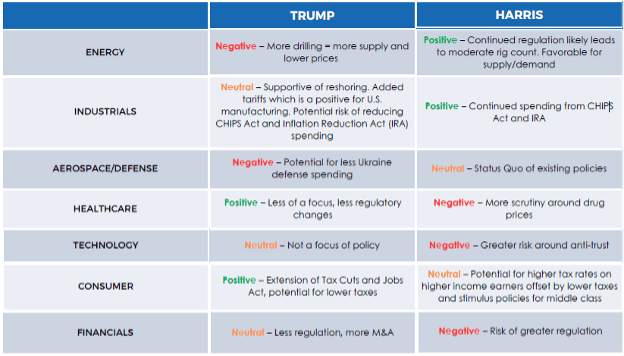

Attention is currently focused on the key policies of the two presidential candidates. While it’s important to understand how these policies could influence the economy and tax policy, the reality is that should we land on a divided government, those policies will have to be adapted for them to be in a form that would be amenable to both parties. Given a greater likelihood of a divided government, we also consider what policies are implemented without legislation (i.e., through executive orders) versus what will require support from the House and Senate.

Among the two candidates, Donald Trump’s policies around immigration, oil drilling, and even additional tariffs could be enacted within the Executive branch. There is some uncertainty, however, on how far a President can go in imposing tariffs without congressional approval. As we assess these policies under a potential second Trump presidency, we acknowledge that many of these have a greater chance of becoming enacted.

Alternatively, a number of the Harris campaign policies are tied to tax reform, which would require the support of the House and Senate. We do note, however, two key policy actions that can be taken by a Harris administration through executive order.

The first would be continued support of Ukraine’s defense in their war against Russia. This would be a positive for defense stocks, which have appreciated by over 60% since Russia’s invasion of Ukraine.3 Second, there is some speculation that a Harris administration will be more active in anti-trust cases. In particular, this could be a challenge to large technology companies that have come under closer scrutiny in Department of Justice investigations.

One key and unavoidable policy will be the potential expiration of the Tax Cut and Jobs Act (TCJA) that was put in place under President Trump. The act is scheduled to expire at the end of 2025. Should it expire without any new legislation, tax rates would go back to what they were before the act was passed at the end of 2017. The TCJA lowered not only corporate tax rates but also rates for individuals. While both candidates have indicated their preferences around how to amend tax policy in conjunction with the sunsetting of the TCJA, a divided government is going to make an extension of the act’s provisions a contentious matter. Considering the divisive views on tax policy between the two parties, we would expect a divided government resulting in a less efficient extension to the TCJA.

Market Impact

Given the uncertainty around the election outcome, we prefer to consider a range of potential scenarios for how markets might play out post-election. To begin with, it’s not unreasonable to assume the outcome of the election may take days or weeks to finalize. Should results remain unclear on Wednesday, November 6th, we could foresee a modest downside to stock prices and rising yields on Treasury bonds. Moreover, the day after the election, Wednesday, November 6th will be eventful given that the Federal Reserve is scheduled to conclude its interest rate policy meeting. Markets presently expect the Fed to reduce interest rates by 0.25%. With markets acutely focused on the Fed at the moment, this will add further frenzy to the week.

In a scenario where there is a second Trump presidency, a growing market consensus is that Trump policies have the potential to be inflationary. More specifically, tariffs and immigration policies could lead to higher prices and wage rates, leading to an inflationary impact. Since neither candidate is focused on reducing the budget deficit, the combination of perceived inflationary policies and continued spending could send Treasury yields higher. On the equity front, the biggest benefit from stocks would be the passage of legislation that would lower corporate tax rates. On a more granular level, sectors with greater regulation, such as financials and utilities, could see some relief from less regulation. The Trump campaign has targeted an increase in oil drilling, a tactic we suspect could lead to an uptick in supply and lower prices. Therefore, we could see the sector underperforming given Trump policies.

Under a Harris presidency, we expect a similar setup to what markets are presently working with as we see similarities with Biden’s policies. This should continue to benefit clean technology companies and defense stocks. Given the proposed policies around providing downpayment support, we could foresee homebuilders seeing an uptick in sentiment. Lastly, the prospect of higher taxes on high-income earners could result in increased demand for tax- exempt municipal bonds, benefiting prices (and lowering yields).

Our Approach

It’s important to recognize that while politicians can form policies and impact the economy and industries, the scope of their impact is often muted and gradual. We don’t typically reference market periods as defined by any particular president’s administration. While it’s important to be mindful of a president’s policies, we don’t believe they should drive one’s investment strategy.

If anything, changes in presidential administrations, and often the tax policies that follow them, can influence how you think about your financial and estate planning needs. This is of paramount importance as it relates to the upcoming election given the expiration of the TCJA at the end of 2025. The uncertainty around the direction of taxes can influence how you want to fund charitable contributions, whether to make a Roth IRA rollover or if it may make sense to realize some capital gains in advance of tax policy changes.

From the standpoint of how we are managing portfolios, while it’s tempting to speculate on the election, we recognize it is too close to call and not appropriate to position one outcome over the other. Often, elections are an event, that once past, are forgotten as investors move on to the next concern. This may be more applicable in the current climate, where there is an above-average probability of a divided government that could constrain the President-Elect’s ability to implement their entire platform.

We wouldn’t be surprised to see a close election result in added market volatility, especially if the uncertainty of the election outcome extends for days or weeks. In fact, following the 2000 election, the delay in declaring a winner resulted in a 12% pullback in the S&P 500. Prices eventually recovered as the uncertainty was removed. We’d likely view any downside volatility surrounding the election to be an opportunity to invest at more attractive prices. As such, we believe it’s more prudent to avoid speculating going into the election and rather be positioned to take advantage of any investment opportunities that occur following the election.

We recognize that ambiguity and uncertainty can be unsettling for investors. The benefit of elections is that they are known events. Therefore, we can plan for them and prepare to react, as necessary, to any dislocations that come from them. As the next week plays out, Miracle Mile Advisors is positioned and prepared to proactively guide our clients through the evolving political picture.

- Bloomberg, Kalshi. As of 10/28/24

- State Street Global Advisors, Bloomberg Finance. As of 12/31/2023

- Bloomberg. Based on performance of SPADE Defense Index 2/24/22 – 10/28/24.

Disclosures: Miracle Mile Advisors LLC (“MMA”) is a registered investment advisor. Advisory services are only offered to clients or prospective clients where MMA and its representatives are properly licensed or exempt from licensure. The views expressed in this commentary are subject to change based on market and other conditions. These documents may contain certain statements that may be deemed forward‐looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur. No investment strategy or risk management technique can guarantee returns or eliminate risk in any market environment. All investments include a risk of loss that clients should be prepared to bear. The principal risks of MMA’s strategies are disclosed in the publicly available Form ADV Part 2A.