ASSESSING CHINA INVESTMENT INSIGHTS

RUSTY HOSS, CFA®– DIRECTOR OF EQUITY RESEARCH

SUMMARY

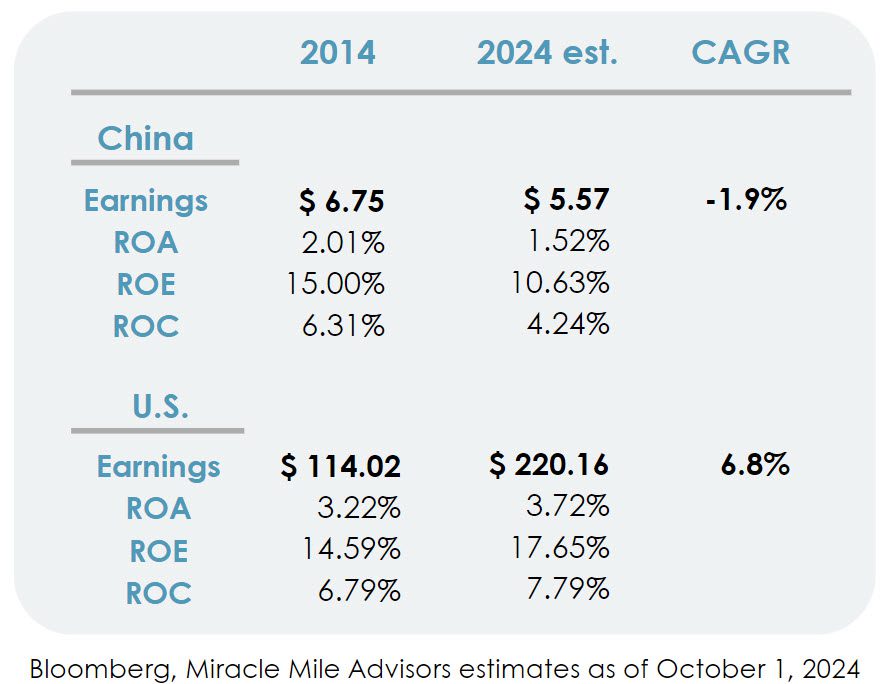

- Over the past decade, Chinese stocks underperformed global peers, including the S&P 500, due to earnings declines and deteriorating levels of profitability.

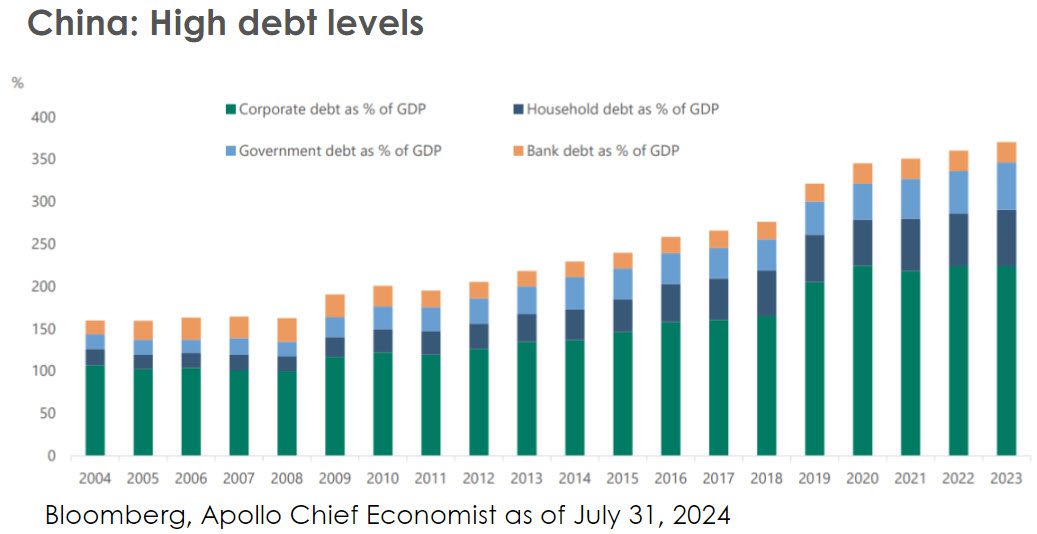

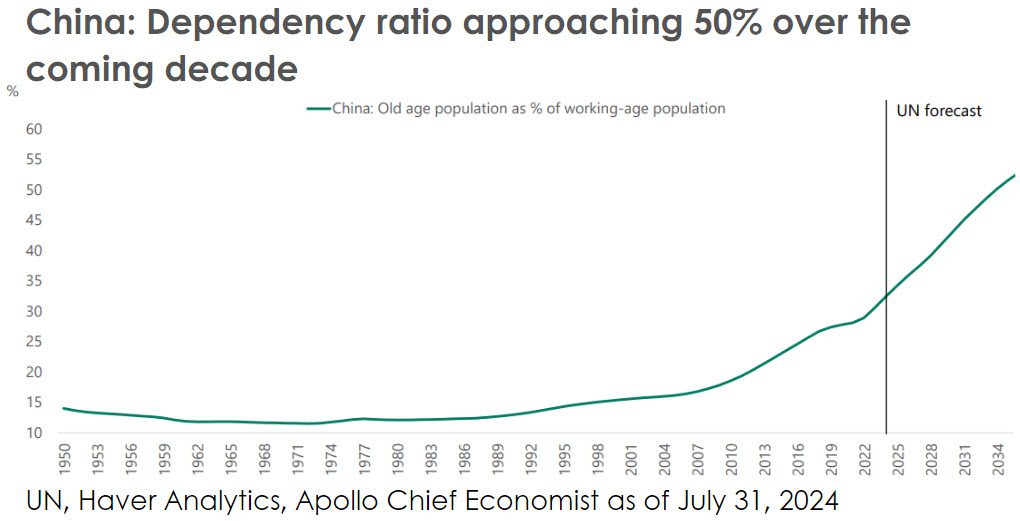

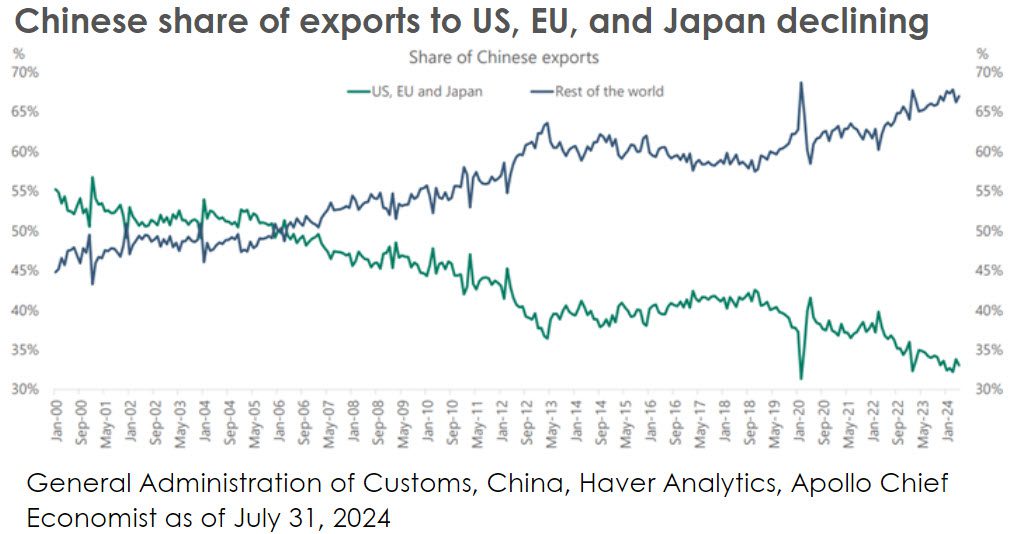

- China’s economy must work through long-term structural chalenges that include high debt levels associated with a multi-decade property and infrastructure boom, a shrinking labor force due to its ageing population, and the falout from deglobalization.

- Recent efforts by the Chinese government to inject stimulus may offer near-term economic support, however, without resolving the underlying structural chalenges, we remain skeptical that Chinese companies wil generate durable earnings growth that can drive long-term stock price appreciation in excess of other global markets, most notably the U.S.

Chinese stocks have performed poorly over the last decade, underperforming their own emerging markets peers, the S&P 500, and a broader universe of global stocks. In the last ten years, the MSCI China index has returned +0.6% annually versus +6.8% for emerging markets and +12.9% for the S&P 500 (Factset, as of August 31, 2024). Given this level of underperformance, there is a tendency for some to expect the negative performance trend to give way to mean reversion – in other words, for Chinese stocks to outperform the S&P 500 given the valuation differential and a decade of underperformance. We are challenged to buy into this thesis given what we view as significant structural challenges for the Chinese economy. We see three primary constraints:

1. China’s underperformance is well supported by weak corporate fundamentals. In the last ten years, earnings of Chinese companies are down roughly 10% and measures of profitability/capital efficiency such as return on assets, return on equity, and return on capital have deteriorated meaningfully. Meanwhile, earnings for S&P 500 companies have doubled and the same measures of profitability/capital efficiency have improvement.

2. China’s economy faces structural challenges that aren’t likely overcome by easier monetary policy or providing consumers with fiscal stimulus. These measures will likely provide relief to the economy and given such negative sentiment and positioning of global investors, stocks are likely to move higher in the short run. However, we see at least three structural headwinds that remain persistent – high levels of debt from a multi-decade property and infrastructure boom, a shrinking labor force due to its aging population, and the fallout from deglobalization.

2. China’s economy faces structural challenges that aren’t likely overcome by easier monetary policy or providing consumers with fiscal stimulus. These measures will likely provide relief to the economy and given such negative sentiment and positioning of global investors, stocks are likely to move higher in the short run. However, we see at least three structural headwinds that remain persistent – high levels of debt from a multi-decade property and infrastructure boom, a shrinking labor force due to its aging population, and the fallout from deglobalization.

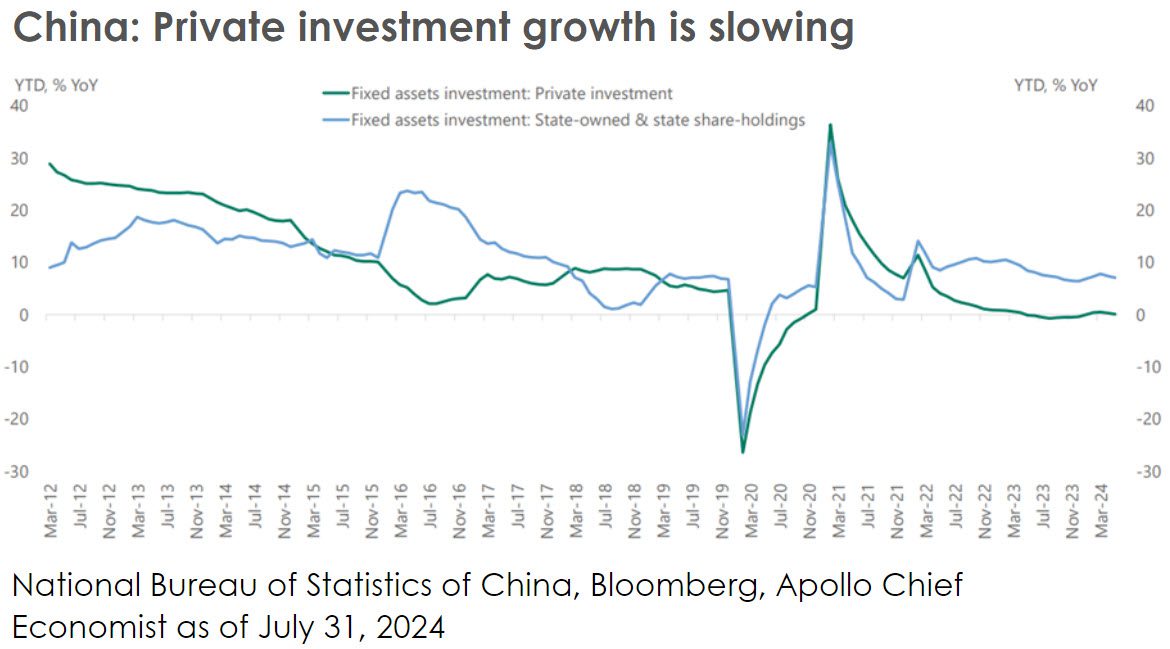

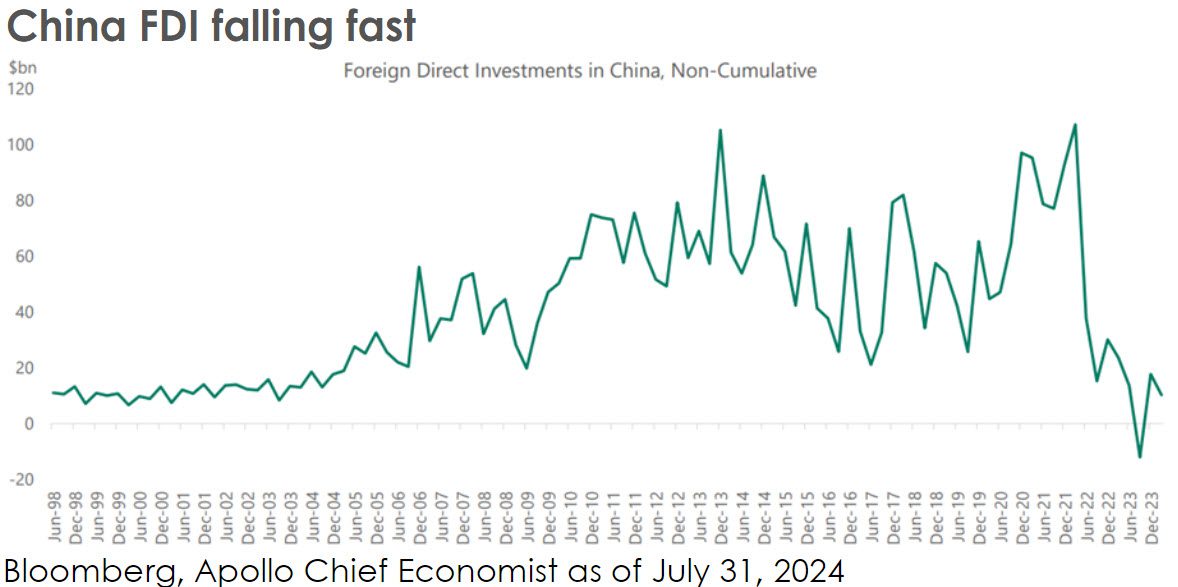

3. Economies that have durable growth (i.e. long-term structural growth) usually have three attributes – entrepreneurship, capital, and an appropriate incentive structure. China has entrepreneurs and capital, but in the last few years, the incentive structure has been distorted by central government policies that are intended to limit the influence of Chinese companies, particularly within the technology sector. As a result, the venture capital/private equity industry – the lifeblood of innovation – is rapidly disappearing. Moreover, foreign direct investment – capital that is invested in a country by foreigners – is also rapidly declining, as capital seeks higher returns in other parts of the world.

At Miracle Mile Advisors, we believe that stock prices follow earnings growth and that this should hold true regardless of where a stock is domiciled. Of course, there can be extenuating circumstances, like geopolitics, liquidity/accessibility, or highly cyclical economies, that result in unpredictable or volatile earnings. If, however, earnings of public companies are growing consistently over time, stock prices should follow earnings and trend higher. While we acknowledge that lower interest rates, fiscal stimulus, and attractive valuations are likely to support economic activity and Chinese stocks in the short term, we doubt these measures will lead to lasting, durable economic activity that allows Chinese public companies to return to growing earnings leading to appreciably higher stock prices.