Top 5 Reasons to Join an Independent Firm

Recently, financial advisors have been straying away from larger institutions in favor of smaller, independent firms. The question is, why is this becoming such a big trend in the industry? We find it to be a variety of reasons, such as a changing industry, changing values and the fact that there are simply better options out there for advisors. As we try to grow our independent practice, we’ve noticed a few common factors that advisors today are looking for in their work. Here are a few:

1. Advisors Want More Freedom

Financial advisors tend to leave larger wirehouses or banks for one important reason: more freedom. Advisors who work for large firms are often restricted to market that firm’s products to their current and prospective clients. In the case that the client is not happy with any of these options, the advisor faces the risk of losing that opportunity. With an independent platform, advisors typically have the freedom to give the financial advice they see fit, whether that’s portfolio recommendations or comprehensive financial planning.

2. Advisors Want the Opportunity to Work at a Smaller Company

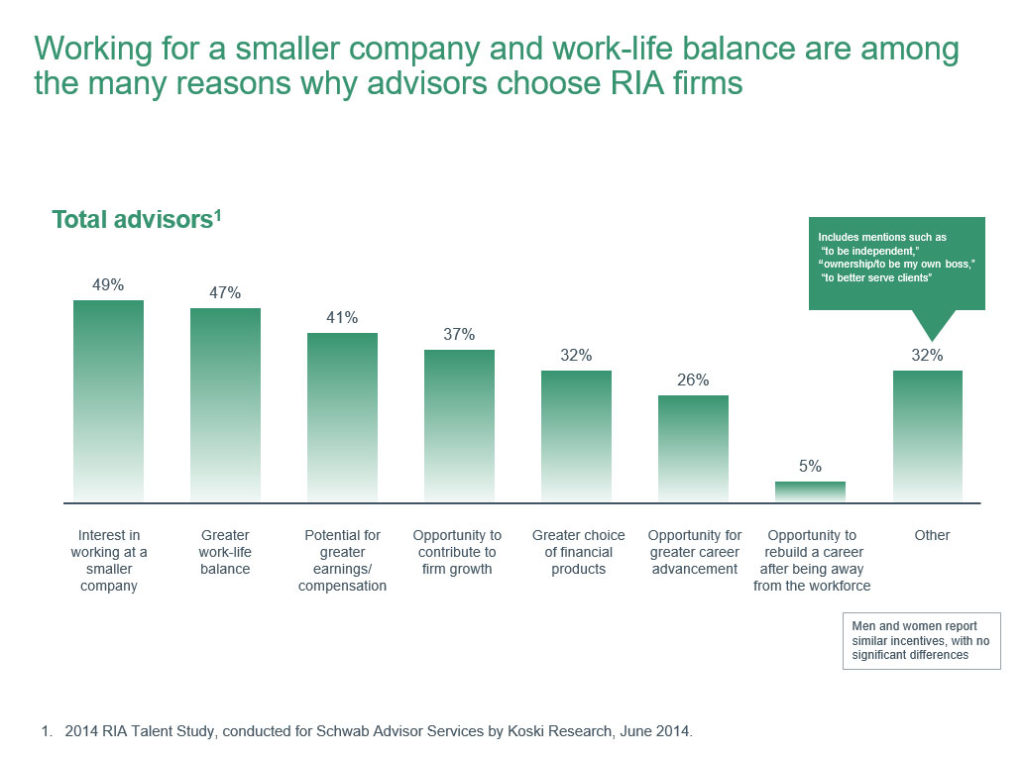

In a recent study by Charles Schwab, 49 percent of advisors said that working at a smaller company was an important factor when they chose to work for an RIA. Becoming an independent advisor does not mean that you have to undertake the daunting task of operating your own business. Joining an RIA firm gives advisors the opportunity to be part of a smaller company’s community and culture while providing the necessary operational infrastructure to succeed.

3. Advisors Want Closer Relationship with Clients

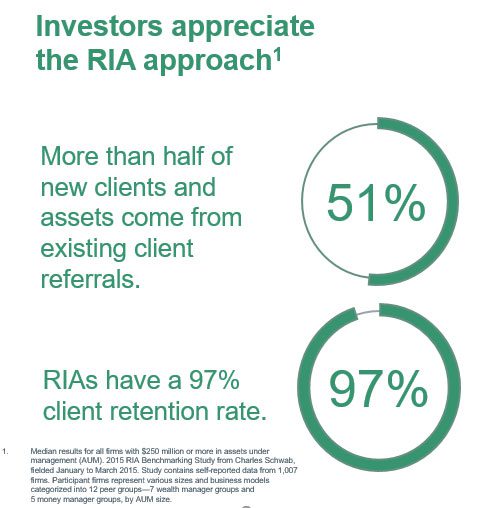

Today, clients are demanding more personalization and financial advisors know this. That’s why building good client relations is more important than ever before. According to a 2016 RIA Benchmarking Study that looked at various factors contributing to a RIA advisor’s growth, stronger client relationships emerged as a vital part of the picture. Working for an RIA firm gives advisors the chance to represent the firm’s brand and become the primary point of contact in the relationship. While technology and human capital push operational efficiency, a stable client relationship coupled with robust business fundamentals are what drives an independent firm’s growth.

4. Advisors Want the Opportunity to Contribute to Firm Growth

In the same study by Charles Schwab, 37 percent of advisors say they joined their RIA to contribute to its growth. With larger firms, advisors opinons are often overshadowed. Smaller firms allow more input and let everyones voice be heard. When working at an RIA, advisors are able to set their own goals and make a substantial difference in their firm’s success, which may not be as significant in a larger Independent Broker Dealer firm. This atmosphere allows for greater personal growth and development for advisors who invested in themselves and their careers.

5. Advisors Want Increased Client Confidence

Unlike brokers who are now being held to a fiduciary standard on retirement accounts only, RIAs are held to a fiduciary standard on all of their investment accounts. RIAs are known to be more objective when giving financial advice to their clients. Furthermore, their clients can confidently accept an RIAs advice knowing that their advisor is not being paid a commission for endorsing their firm’s recommended investments.

As the financial industry continues to evolve, many advisors are choosing a new path that provides the benefits of flexibility and full transparency. The opportunity to contribute to firm growth will help to advance your career and build a stronger relationship with clients that will serve to help you in your future endeavors. Overall, independence is a win for both advisors and clients.

Miracle Mile Advisors is a leader in providing independent investment advice through active indexing to high net worth families and businesses nationwide. As one of the fastest growing independent registered investment advisors in Los Angeles, the firm is committed to developing tax-efficient portfolios that benefit from the lower cost and liquidity characteristics of Exchange Traded Funds (ETFs).