Making a Career Change in a Post-Fiduciary World

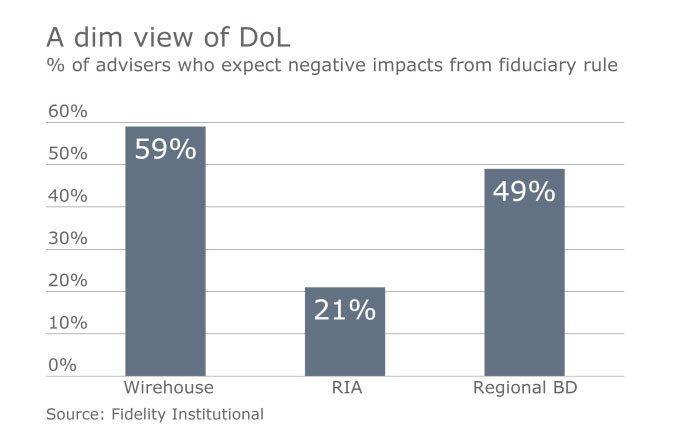

According to a new survey conducted by Fidelity, about 20 percent of advisors are considering a career change just months before the Department of Labor’s Fiduciary Rule is proposed to go into effect. For advisors who are helping their clients plan for retirement, there’s no denying that this rule will mean big changes for their business models and proceedings. Brokers and wirehouse advisors in particular are considering a change as the rule most directly impacts them. The same Fidelity study reported that 59 percent of wirehouse advisors are expecting a negative impact from the new rule starting in April 2017.

Although this new rule is certainly complex with many specifics, two basic changes that are impacting the financial services industry have to do with fiduciary standard and conflicts on interest First, the rule requires all advisors providing advice to IRAs and 401(k)s to adhere to a fiduciary standard of care, acting in the best interest of the client. Secondly, the rule requires a fiduciary to remove or mitigate potential conflicts of interest, which include certain types of fees. Wirehouse advisors use a commission-based model, and likely won’t be as profitable when the new regulation goes into full effect. Conversely, RIAs already adhere to a fiduciary standard, and therefore won’t be impacted. Fidelity notes that “A slight majority of advisers – 53% — still see the rule having an overall negative impact; 61% of advisers say it will raise the cost of doing business and 47% expect it to hurt their compensation.” No one wants to see their compensation diminish. There are options out there that offer a competitive compensation package even when the DOL rule is in effect.

While a career change is certainly easier said than done and depending on where you are in life, might not make sense. Here are a few options for advisors to consider in the post-fiduciary rule world:

1. Remain as an independent broker-dealer

With the fiduciary rule set to go into place in April 2017, some of the biggest wirehouses in the country are already announcing their plans for compliance. From there, it’ll be up to individual advisors to decide their path of action, based on how their firm is adjusting for the rule. However, the majority of advisors at these firms appear to be considering a change. This is likely because they are faced with a large disruption in business with massive projected profit loss. A study by A.T Kearney predicted that the new rule will cost the brokerage industry nearly $11 billion over the next four years.

In addition, advisors who continue to accept commissions or revenue sharing will be required to have their clients sign into a best interest contract exemption (BICE).

Investors with such a contract in place will be able to sue their advisors if they believe their interests haven’t been put first, and the courts have made it clear that they will not tolerate this. Client lawsuits are expected to increase after the DOL rule is fully implemented in January 2018.

Heightened liability is not something that an advisor should have to be concerned about. This fact alone is reason that so many advisors are opening up to new options.

2. Start your own RIA firm

If you’re a current broker or wirehouse advisor who has decided to make a change, you have a couple of options. One option is to start your own Registered Investment Advisory firm. However, this can be a long and daunting process with many possible risks. Before you jump in, it’s important to educate yourself on all the steps necessary to becoming an independent RIA. This comprehensive list becomes daunting, fast, and may take months to complete.

If you like the sense of freedom, but don’t want the responsibility and headaches of starting your own firm, joining an existing RIA might be an option to consider.

3. Join an existing RIA firm

The third option seems to be the best compromise between the two. Joining an existing RIA firm gives you all the benefits of partnering with an independent firm, without the burden of starting it from scratch. RIA firms already operate under the same principles the fiduciary rule enforces and are already preparing for any additional changes or requirements, thus expect to brace little to no impact. There are also numerous personal benefits from working at an RIA, including: more input in the firm, more freedom with investment advice and the ability to work with clients you enjoy while surrounding yourself with the team you want.

Although all three of these are viable options, the best choice for an advisor looking to make a change seems to be joining an existing RIA firm. This option offers independence without the staggering profit losses predicted for wirehouses and brokerage firms, and the operational burdens of setting up shop.

At Miracle Mile, we have spent the past 10 years creating a platform that allows our advisors to deliver sophisticated, comprehensive advice in an environment that is conducive to success.

Miracle Mile Advisors is a leader in providing independent investment advice through active indexing to high net worth families and businesses nationwide. As one of the fastest growing independent registered investment advisors in Los Angeles, the firm is committed to developing tax-efficient portfolios that benefit from the lower cost and liquidity characteristics of Exchange Traded Funds (ETFs). To learn more about Miracle Mile Advisors, please visit www.p7w.4de.myftpupload.com.